Everything about Nj Cash Buyers

Table of ContentsNj Cash Buyers - An OverviewThe Of Nj Cash BuyersUnknown Facts About Nj Cash BuyersThe smart Trick of Nj Cash Buyers That Nobody is Discussing6 Simple Techniques For Nj Cash BuyersThe smart Trick of Nj Cash Buyers That Nobody is DiscussingSome Of Nj Cash Buyers

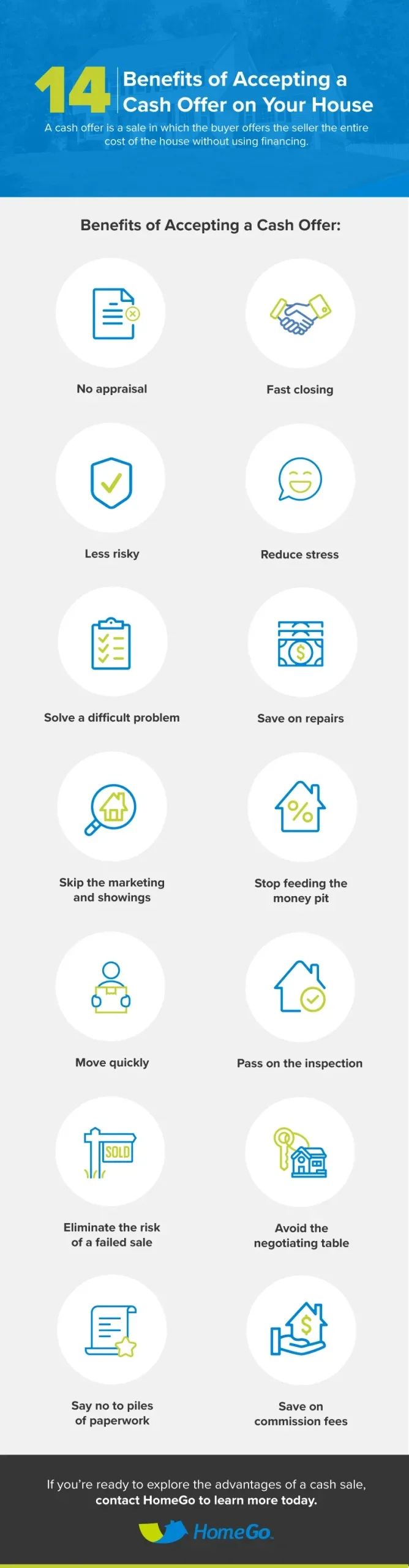

Cash offers additionally give a feeling of safety and security for the seller as they get rid of the risk of a bargain failing due to funding concerns. Generally, the benefits of cash deals are clear, making it a popular selection for sellers seeking to improve their home offering process. For informative purposes only.

While home-sellers will likely conserve thousands in commission, conformity and litigation threats have actually considerably increased for vendors throughout the nation. These kinds of homes are usually owned by people who want to sell their residential or commercial property rapidly, and for this reason, they prefer cash money home purchasers.

It is feasible to purchase a home with money. There are both advantages and downsides to paying cash for a home.

The Basic Principles Of Nj Cash Buyers

However, making use of cash money to purchase a home bind a sizable portion of funding in an illiquid possession, postponing instantaneous access to cash. It also implies shedding out on particular tax obligation breaks connected to interest paid on a home loan. Consider your objectives, economic status, and tax obligation exemptions before purchasing a home with cash.

Purchasing a home in money can deplete your liquid assets, leaving you with minimal funds for emergencies. It's important to make certain that you still have sufficient cash reserves or access to credit score lines. One benefit of obtaining a home mortgage is the potential to deduct the passion paid on the funding.

Others are comfortable lugging home loan debt and leveraging their properties for prospective growth. Acquiring a home with cash has even more benefits than drawbacks, that include: By paying in money for the building, you get rid of the need to pay passion on a home loan. This can save you a substantial amount of cash over the lending's life.

The Only Guide to Nj Cash Buyers

By paying cash money, you miss out on this tax obligation benefit. Having a home outright can leave you with limited liquid properties offered for emergencies, unexpected expenditures, or other economic requirements. Below are some compelling factors to consider obtaining a mortgage rather than paying money for a house:: By securing a home loan, you have the ability to take advantage of your financial investment and possibly attain higher returns.

(https://www.blurb.com/user/njcashbuyer1?profile_preview=true)As opposed to linking up a substantial amount of money in your home, you can keep those funds offered for various other financial investment opportunities.: By not placing all your readily available cash into a solitary property, you can keep a more diversified financial investment portfolio. Portfolio diversity is an essential threat monitoring strategy. Paying money for a house supplies many benefits, boosting the percentage of all-cash realty bargains.

The cash money acquisition home process entails binding a considerable part of liquid assets, possibly restricting financial investment diversification. On the other hand, obtaining a mortgage permits leveraging investments, maintaining liquidity, and potentially maximizing tax obligation advantages. Whether acquiring a home or home loan, it is necessary to depend on a reputable actual estate platform such as Houzeo.

Indicators on Nj Cash Buyers You Should Know

With thousands of property listings, is one of the largest home noting sites in the US. Yes, you can buy a house with money, which is much simpler and useful than using for home mortgages.

Paying money for a home binds a big amount of your fluid assets, and limit your financial adaptability. In addition, you miss out on out on tax obligation benefits from home loan interest deductions and the opportunity to spend that cash in other places for possibly higher returns. Professionals indicate that also if you have the cash to acquire a home, you should obtain a home mortgage for tax exceptions and better liquidity.

Nj Cash Buyers for Beginners

But, all-cash sales are coming to be progressively preferred, accounting for nearly 40% of single-family home and apartment sales in Q2 2024, according to realty information company ATTOM. we buy houses for cash new jersey. In 2023's seller's market, numerous purchasers had the ability to win quotes and save money on interest thanks to cash offers. Cash deals commonly bring about a quicker closing procedure, which tempts vendors to approve such proposals.

These expenses are normally reduced in a cash money sale than in a typical sale, yet they still need to be covered.

Some Known Factual Statements About Nj Cash Buyers

Cash money buyers have a side when bargaining given that sellers prefer to collaborate with those that can close promptly without requiring contingencies to fund a procurement. This can lead to discounts or positive terms which increase success for an investment decision. Money purchasers do not need to bother with rate of interest variations and the possible repossession threats that go along with leveraged financial investments, making cash money acquisitions feel more secure during financial recessions.

By paying cash for a rental home purchase, you are locking away capital that could otherwise have been deployed somewhere else and produced greater returns. Getting with such large sums limitations liquidity and diversification along with prevents general portfolio development. Money purchasers commonly ignore the benefits of using other individuals's funds as home mortgages to increase investment returns greatly much faster, which could postpone wealth build-up greatly without leveraged investments.

Cash purchasers may miss out on out on particular deductions that might harm general returns. A financial investment that includes alloting significant sums of money in the direction of one home could pose focus risk if its efficiency experiences or unforeseen difficulties emerge, providing higher security and resilience across your profile of buildings or asset courses.

See This Report about Nj Cash Buyers

, but when home loan prices are high, there's an additional: Borrowing cash is costly, and paying for the home in complete assists you avoid the regular monthly responsibility of home loan repayments and rate of interest. Of program, many Americans don't have hundreds of thousands of dollars lying around waiting to be spent.

Even if you can afford to purchase a house in cash, should you? Is it a smart idea? Right here are the advantages and disadvantages. Yes, it is possible and perfectly lawful to buy a home in full, equally as you would certainly a smaller-ticket product like, say, a coat. This is described as an all-cash bargain, also if you're not really paying in fiat money.